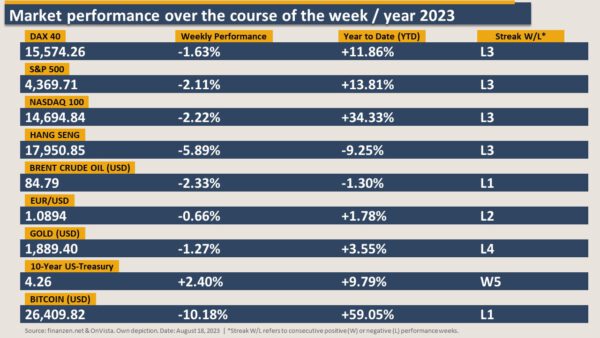

The heat is back, ladies and gentlemen, and we’re feeling it both here in Frankfurt and on the stock market. The S&P 500, Nasdaq, Dax & Co. are all on losing streaks. On the other hand, US 10-year treasury yields have reached another record high for this year, extending their winning streak to five weeks. However, as you can probably infer from the performance table below, this week’s major topic was China.

The Chinese stock market took a significant hit this week after the release of disappointing data. As some of you might recall, as we entered 2023, there were rising expectations that China would return to its rapid growth. After three years of economic lockdown, the country seemed to be resuming business as usual. However, these expectations have not been met, and alongside this dwindling optimism, the Chinese economy is also showing signs of fading. On the external front, China is grappling with declining foreign trade. Domestically, its property sector remains in jeopardy, the Yuan faces periodic deflation, and there’s an increasing challenge in generating enough jobs for its graduates.

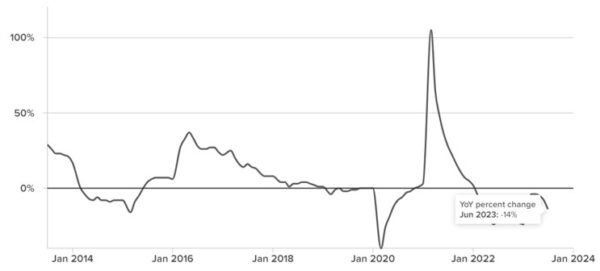

The Chinese real estate market’s issues are evident, as indicated by the chart below. As of June 2023, property sales have declined by 14% year-on-year. Falling prices and sales continue to strain developers’ finances, a significant concern given that real estate and related industries contribute approximately 30 percent of China’s GDP — nearly double its share in the United States.

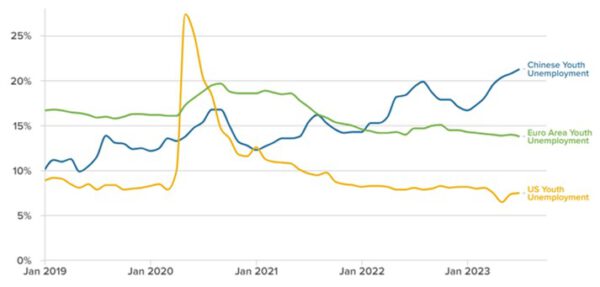

As if these challenges weren’t enough, unemployment rates among the youth in China are climbing at an alarming rate. While unemployment rates are generally higher among the youth, the chart below shows a concerning trend of increasing youth unemployment in China, whereas in the Euro area and the United States, unemployment is decreasing. This situation could prompt young talents to leave the country in search of better opportunities.

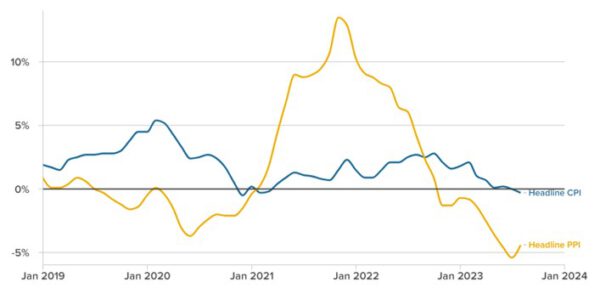

One more chart to discuss before we wrap up. Deflation, a topic economists and central bankers often avoid, is sometimes inevitable. Both the headline CPI and PPI in China have entered deflationary territory. It’s almost like we’re in a parallel universe, considering the rest of the world is still grappling with rising prices.

Clearly, the Chinese government and its central bankers aren’t just standing by. China’s central bank recently cut one set of key interest rates and followed it with cuts to other rates hours later. Only time will determine if these actions will be enough to ignite a turnaround, or at least temper the current downturn. It’s crucial to understand that China’s situation isn’t isolated, and it carries implications for the global economy.

Last Week’s Market Performance: A Global Overview

Last Week’s Survey Results | Calendar Week 33/2023

In last week’s poll, 64% of LinkedIn participants (slightly up from 61% the previous week) and 80% of Instagram participants (up from 67% the previous week) were bullish. The S&P 500 closed its third consecutive week on a negative note, finishing at -2.11%, primarily due to news emerging from China.

If you want to participate in my weekly polls, make sure to activate the notifications button on LinkedIn, and you’ll be notified every Saturday at 8 P.M. (CET).

You can still vote here in this week’s poll.

Cheerio!

Endrit Cela The Investment Fella – #ECB #mm #411 🦍